By: Larry Rulison, Staff Writer - Times Union

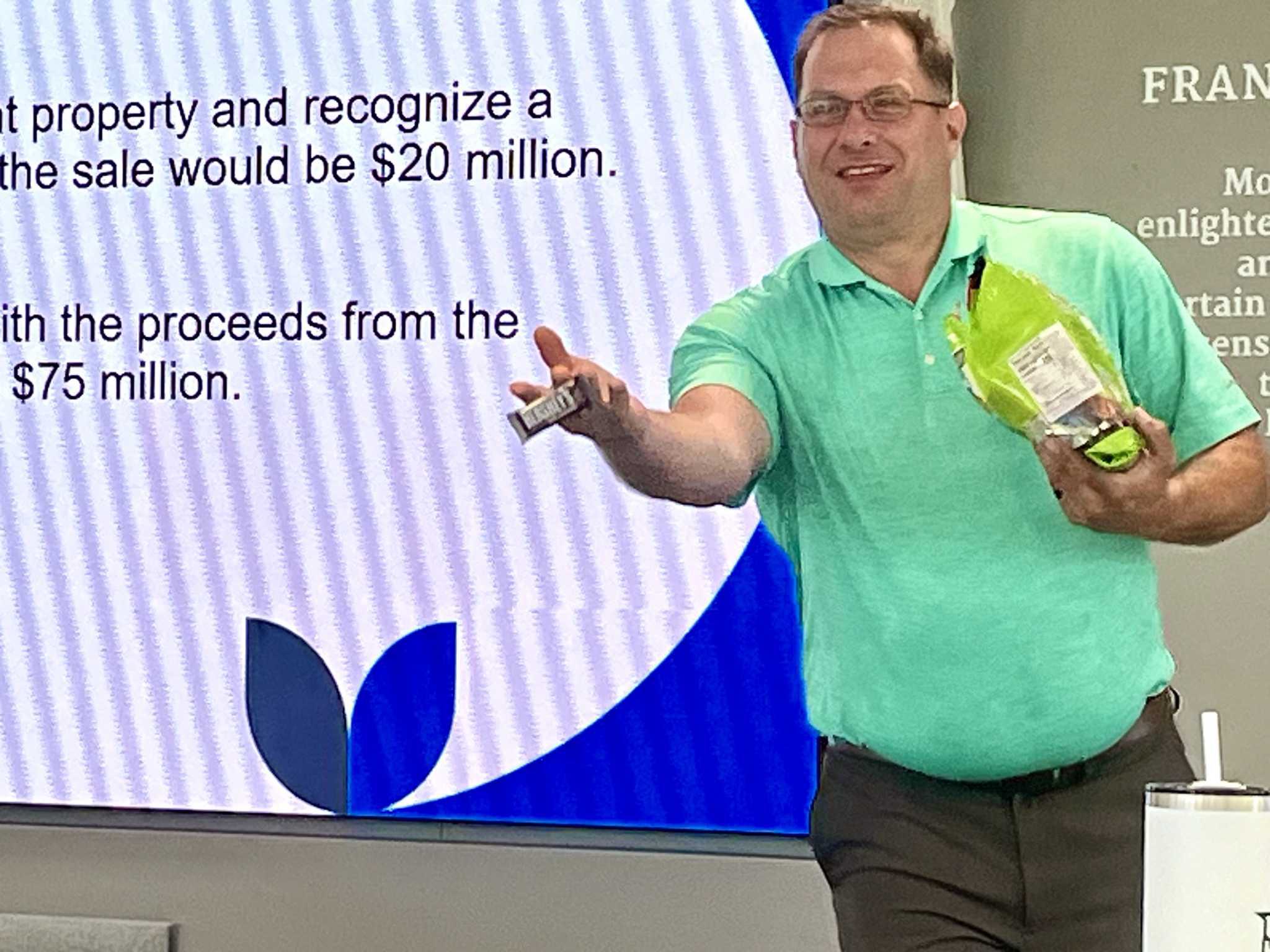

COLONIE — Jeremy Cole was throwing candy at high school students on a Tuesday afternoon at Siena College earlier this month.

Not exactly the type of behavior one would expect from an accountant.

But Cole and other professionals in the accounting industry and willing to try almost anything these days to address a growing workforce crisis caused by two major trends.

First, a record number of senior CPAs and accounting professionals are planning to retire in the coming years, according to the American Institute of Certified Public Accountants.

And secondly, the young college grads that have for decades worked their way to an accounting degree just aren’t there anymore. Fewer college students are interested in accounting.

On a Tuesday afternoon earlier this month, Cole and other local accounting professionals, most of then from BST & Co. CPAs of Colonie, did their best to reverse at least one of those two trends by telling a group of more than 30 local high schoolers how fun and rewarding the accounting profession can be and how the industry has changed in recent years to become more dynamic, especially with the advent of artificial intelligence, or AI.

Cole was actually throwing candy with a purpose: Each student who asked a question of Cole and his speaking partner William Sullivan of Spring Street Tax Resources was tossed a treat from Cole’s Halloween-sized bag of candy.

Cole and Sullivan were keeping it breezy with the students, who came from 18 area schools to spend two days at Siena College as part of a career program sponsored by the New York State Society of CPAs.

The pair gave them real-world clients issues they have faced and rewarding challenges they have had to face in their profession. Their main message was that every day dealing with a client, especially a small business, is different, and there is never a dull moment. It’s not just entering numbers in a ledger. It’s about problem-solving, say for a client who is wondering what the tax advantages are of moving to Florida. Or what another developer client should do with $50 million in proceeds from the sale of an investment property. The answers come from both the tax law and from their knowledge of the business world.

“We get a lot of questions from clients,” Cole told the students. “We see everything. There’s a lot of variety.” One of the leading voices in the local accounting field, Beth van Bladel, also spoke with the students. van Bladel is director of BST’s CFO for Hire division in which BST accountants are “outsourced” to other companies in either long-term or short-term assignments. van Bladel is also president of the northeast chapter of the NYSSCPA, the organization that runs the two-day program, officially known as the Career Opportunities in the Accounting Profession. van Bladel is always trying to recruit new accountants for BST and the industry in general. One of those recruits was Laura Grippin, a senior accounting specialist at CFO for Hire, who also spoke at the Siena event. Grippin was an intern at CFO for Hire while she was earning her accounting degree from the College of Saint Rose.

van Bladel says the accounting profession is much more dynamic than people expect. And today’s students might not know that. She also says that the accounting industry has pulled back from taking on as much client work as possible to the point where CPA firms have become fiscal factories.

“There’s a perception that accounting is maybe not as interesting (as other jobs),” van Bladel said in an interview after her presentation on July 9. “In the old days, it used to be when the economy was really tight,accounting will give you a secure job, a well paying job. But nowadays we’re finding that students care more about their quality of life, what are they doing.”

van Bladel says that CPA firms have had to adjust to this new worker who values their free time just as much as their professional careers.

“There was a perception that we work a lot of hard hours and busy seasons and so forth,” van Bladel said. “And I think the the firms are recognizing the fact, and the industry and the profession is recognizing the fact that we need to do things differently, and maybe not take on every client so that we overload our staff.”

van Bladel added that the NYSSCPA’s drive to get more students to take accounting in college has focused on “underpresented” groups in high schools in Albany, Troy and Schenectady and as far away as Herkimer.

With a large portion of the workforce, Baby Boomers and Generation X, headed to retirement age, AI has definitely helped the accounting industry along with almost every other segment of the economy. AI is used in accounting to streamline data collection, ranging from scanning bills payable to contract and lease terms that in the past had to be manually inputting in accounting systems.

These days, that’s become a commodity that can be done by a computer program and a computer chip instead of an accountant. That frees up the CPA for more in-depth consultation with clients. That’s where the real value is in a CPA. Everyone knows, or should know, the tax code and how to fill out a tax return. But judgment is something that a CPA can bring to the table.

“It’s freeing us up,” van Bladel said. “It’s very helpful because the workforce has definitely retracted. It’s really survival. And to be honest, for me to be relevant and to be employable, I need to embrace and learn this technology. Otherwise, I’m not gonna have a job.”

As first seen published in the Times Union by Larry Rulison.